I’ve know about the US Bank Flexperks Travel Rewards Signature Visa for a long time, but didn’t really care for it since I have plenty of other cards. After looking at it a bit futher, I realize it has good potential for the frequent flyer.

The Key Points of the card:

- No annual fee first year, $49 thereafter

- Current signup bonus: 20,000 flexperks points after $3,500 spend in 3 months

- One FlexPoint for every $1 spent in net purchases.

- 2x FlexPoints on the category you spend the most on (gas, groceries or airlines) and most cell phone expenses during each billing cycle.3

- 3x FlexPoints on qualifying charitable donations.

- If you spend $24,000 a year, you get 3,500 additional Flexperks points which can be used to offset your annual fee

- Get up to a $25 airline allowance with every award travel ticket good towards baggage fees, in-flight treats and more

Although there are a lot of redemption options such as cash back or gift cards, most of them give you 1 cent per point. However, that’s not where the maximum value seems to be.

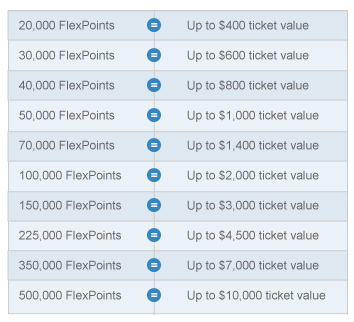

The maximum value can be obtained when you redeem the flexperks points for flights. Basically, you can redeem up to 2 cents per flexperk point value when redeeming for flights. See the chart below.

To get the maximum value from 20,000 points, you would have to find a flight that is exactly $400. Let’s say you found a flight that’s $350, now you are getting 1.75 cents per point in value. However, this is still better than redeeming for gift cards or cash back. It doesn’t make sense to book any flight $200 or less (redemption value of 1 cent per point or less) as you can clearly do better.

You can book the flight once you login to your US Bank account. The travel portal used to find the flights is run by Travelocity, so the fares should technically be identical to what you find on travelocity.

Thus, the signup bonus of 20,000 points gives you a free domestic flight worth up to $400. The best part of using these flexperks points is that since it’s a paid flight, you will accrue frequent flyer miles on the flight that you take.

US Bank sometimes has higher signup bonuses, usually during the olympics, so perhaps that’s a better time to apply for the card. Maximizing value from this card deserves a separate post.

One small important fact you should know from the US Bank website:

We will first consider you for the U.S. Bank FlexPerks Travel Rewards Visa Signature card. If you are not eligible for the Travel Rewards card, you’ll automatically be considered for the U.S. Bank FlexPerks Select Rewards card which earns 10,000 Enrollment Bonus FlexPoints after spending $1,000 within the first four months, earns 1 FlexPoint for every $2 in net purchases and has no annual fee. The Select Rewards card is not eligible for the double FlexPoints on highest spend in each monthly billing cycle and on cell phone expenses but does earn 1.5 FlexPoints for charitable donations.

Pingback: Get Free Flights with Flexperks Travel Rewards Signature Visa