Up until this year, I had always paid my taxes with a check. I hated doing that since I wouldn’t earn miles in the process. I knew that the IRS allows for payment of taxes with a credit card. However, paying with a credit card would incur processing fees ranging from 1.87% – 2.35% depending on the credit card you use. Normally, that’s not a wise decision as the fees pretty much negate any miles earned from a miles earning credit card.

This year, I decided to do something different. I decided to pay part of my taxes with American Express Gift cards. Recently, there was a 3% cash back on the purchase of American Express gift cards through topcashback.

I ordered $5000 worth of gift cards on my Southwest Airlines Premier card. Shipping fees for the cards was $8.95. Since the highest denomination gift card is $3000, I purchased that and an additional $2K gift card. I couldn’t purchase more than $5K because that is the limit every 14 days.

I then decided to use www.payusatax.com to make my tax payments and use up both of my gift cards. The process is pretty self explanatory. Follow the prompts and proceed through the transaction like you would on any website. They charge the lowest fee of 1.87% on American Express credit cards. Since I had 2 different gift cards, I made 2 separate payments keeping in mind that I had to account for the fees.

On the $2000 card:

I made a payment of $1963.28. The 1.87% processing fee came out to $36.71. The total charged to the card was $1999.99. So I had 1 cent left on my gift card.

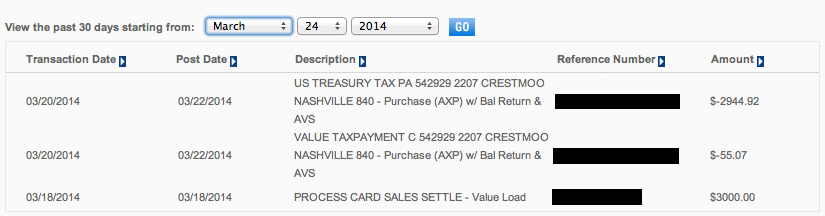

On the $3000 card:

I made a payment of $2944.92, a fee of $55.07 for a total of $2999.99.

Soon after the payment, I received confirmation of payment from payusatax. You can also verify your payment on their website.

Just to be sure, I decided to check my Amex gift card balance and saw that each one had been appropriately charged.

My takeaway from paying taxes with American Express gift cards:

- 5009 Rapid Rewards points

- $58.22 profit ($150 cash back from topcashback – $91.78 in Processing fees for taxes)

Things I learned when paying taxes with American Express gift cards:

- There is no “hold” that is placed on the card. If you have $3000 gift card, you can use the whole amount.

- There are limits on how many payments you can make depending on the tax form you are filing. For estimated taxes for the current year, it’s 2 payments a quarter. However, if you are paying the balance due for past year’s taxes, it’s 2 payments a year.

- You can see the payment amount and processing fees separately before confirming your payment, so you know exactly what you are paying.

- I would recommend calling the customer service on the back of your card to register your name and address before using it online for a large amount.

- I called customer service and was told it would actually take 5-7 days for the payment to post to the IRS, so I wouldn’t wait until the last day to do this.

- I partially paid my taxes using the Amex gift cards. I e-filed the remaining balance. I would have loved to pay with more gift cards, but my impression was that I was limited to 2 payments.

- It’s a good idea to verify your payment on both the payusatax website and also check the Amex gift card balance.

- Clearly, this is a great way to earn miles from your credit card and make some money. If you’ve never considered paying taxes this way, you should.

If you are looking to learn more about Amex gift cards, Miles Points and Mai Tais has a nice 411 on the topic.

If you enjoy credit card rewards, travel, tips and tricks, then subscribe to the blog via email, like us on facebook or follow me on twitter!

Great info!

Your Amex gift cards were processed at 1.87% as if they were credit cards.

Why were they not processed as debit card transactions? The debit card transactions incur a $2.79 fee per card. I have used gift cards to pay taxes at ChoicePay and Official Payments and have been charged the debit flat fee per card. Just need some clarification. Thanks.

Charles

Chances are the gift cards you used were either Visa or MasterCard as those are PIN enabled. That’s not the case with Amex gift cards, as you cannot set a PIN and use them as debit cards. They can only be used as credit. I have never seen an Amex debit card, have you?

In the past, I have purchased Visa, MasterCard, and Amex gift cards from OfficeMax. In December 2013, I bought ten $100 Amex prepaid gift cards. I called Official Payments and the CSR processed all ten and charged a flat fee of $3.95 each. The $3.95 was probably charged because it was the minimum convenience fee. So, it is probable that they charge a percentage over a certain amount.

Official Payments and ChoicePay will process an unlimited number of gift cards over the phone. ChoicePay is cheaper but does not process Amex.

I didn’t know you could process multiple cards, since I was just reading the limits on the IRS website. Thanks for that info.

Welcome:)