*NO affiliate links in this post*

It always amazes me that banks and hotels with their lucrative credit card bonuses make it easy for me to travel in premium cabins and stay in hotel rooms that I normally would never pay for. Anyone can do the same, as long as they are savvy with their credit management.

Hotel branded credit cards can easily offer enough points for free nights at some of the best hotels in the world. Although the bonus points are great when one person gets them, the doubling of rewards when your spouse or significant other applies for the same card is even better.

With proper planning, a couple can get free or nearly free hotel nights for their dream honeymoon or vacation.

I’ve compiled below what I believe to be the best hotel credit cards that a couple can take advantage of and tips to maximize the benefits:

- Bonus: 2 free nights at any Hyatt worldwide after spending $1000 within 3 months

- Annual fee: No fee first year, $75 thereafter

- There is an offer where you can even get $50 statement credit. Try to make a dummy reservation on Hyatt and you will see the offer on the confirmation screen

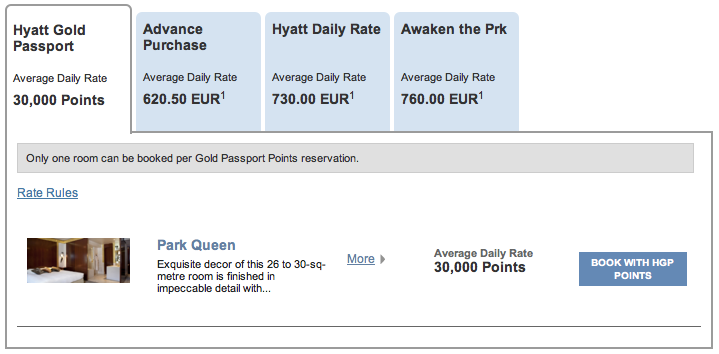

If your significant other gets the card as well, that’s 4 free nights. The best and most expensive Hyatt hotels include the category 7 Park Hyatt Hotels such as Park Hyatt Vendome Paris, Park Hyatt Tokyo, Park Hyatt Sydney and more. These can be booked for 30,000 Hyatt points a night. This means the 2 free nights signup bonus is worth 60,000 Hyatt points.

To put this in perspective, below is an example of a Friday-Sunday stay at the Park Hyatt Vendome for this upcoming summer:

A 2 night stay would cost you 1241 Euros plus taxes or 1 application for the Hyatt credit card.

2. Club Carlson Premier Rewards Visa Signature

- Signup Bonus: 85,000 Points (50,000 points after 1st purchase and 35,000 points after $2500 spend in 3 months)

- Annual fee: $75 not waived

- Annual bonus: 40,000 Points

Club Carlson’s award chart shows that its category 6 hotels cost 50,000 points per night while category 7 hotels cost 70,000 points per night. The best part of this card is the “last night free” on award stays of 2 nights or more. The greatest yield is when you redeem for 2 nights as it’s redeem 1, get 1 free. Thus, with your signup bonus, you can redeem 70,000 points for 2 nights at a category 7 hotel.

If your significant other gets the card as well, you are getting 170,000 points for $150. If you choose to redeem for the 50,000 point nights, you can get 6 nights at category 6 hotels and still have 20,000 points leftover. You can combine balances between accounts to accomplish this.

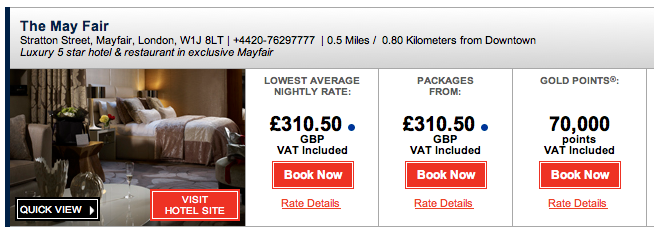

How about a Friday-Sunday stay at The May Fair London in the summer:

2 nights would be 621 British Pounds plus taxes or 70,000 points total if you hold the Club Carlson card.

3. Starwood Preferred Guest American Express Card

- Signup bonus: 25,000 SPG points (10,000 after 1st purchase and 15,000 points after $5000 in purchases in 6 months)

- Annual Fee: Waived first year, $65 thereafter

According to the SPG award chart, SPG category 5 hotels can be redeemed for 12,000 points during the low season. Thus, the signup bonus is equivalent to 2 free nights at these hotels.

Again, if your significant other gets the card as well, that’s a total of 50,000 points. Starwood allows you to combine points in accounts with some restrictions.

The reason you would want to combine these points if because if you redeem for 4 nights, the 5th night is free.

Here’s an example of a 2 night stay at the Park Lane London:

By combining points, you can get 5 nights there for 48,000 points.

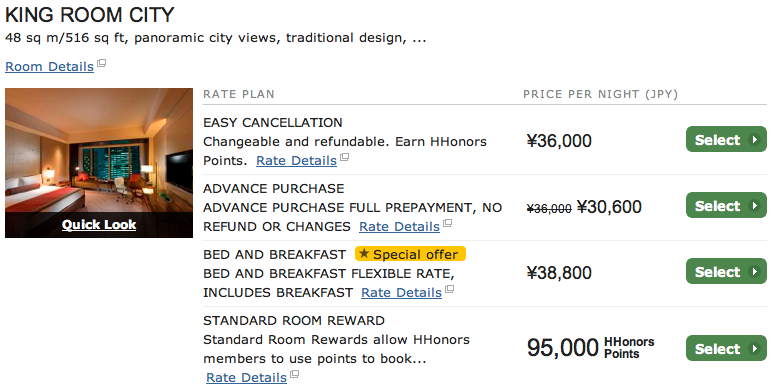

4. Citi Hilton HHonors Reserve with $100 statement credit

- Signup bonus: $100 statement credit and 2 free weekend nights after $2500 spend in 3 months

- Annual fee: $95 not waived first year

The beauty of this card is that you can use the free weekend nights for the highest category Hilton hotels. These category 10 hotels range in price from 70,000 to 95,000 points per night. Thus, the value of this card can be as high as 190,000 Hilton points. In addition, you get Hilton Gold for as long as you have the card, which gets you free internet and breakfast.

Double the rewards with your loved one and you can have a fabulous four nights at the Conrad Tokyo.

Here’s an example of a Friday-Sunday stay at the Conrad Tokyo. The advance purchase rate is about $300 plus taxes per night (actually cheap).

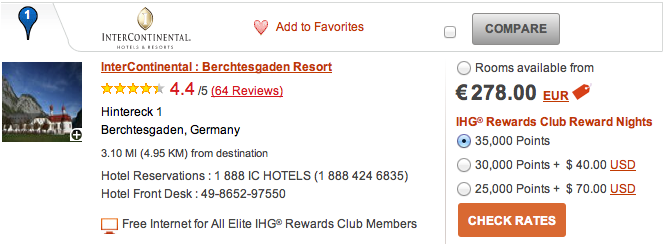

5. Chase IHG Rewards Club Mastercard (80,000 point link)

- Signup Bonus: 80,000 points after $1000 spend in 3 months

- Annual fee: Waived first year, $49 thereafter

I’ve written about the 80,000 point offer before. Read that first because there are lower point offers out there. In addition to the 80,000 points, you get IHG Platinum status, 10% rebate on all points redemptions and 1 free night annual after the first anniversary at any IHG property in the world. That’s easily worth the $49 annual fee.

Double the fun with your loved one to get 160,000 points.

Here’s an example of 2 nights at the Intercontinental Berchtesgaden

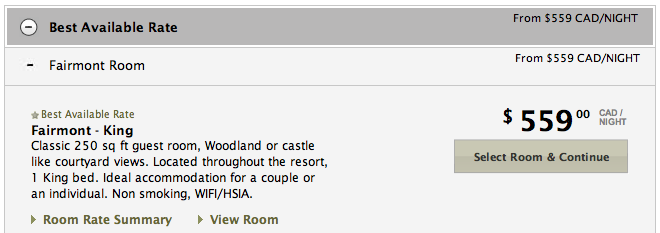

- Signup Bonus: 2 free nights after $1000 spend in 3 months

- Annual fee: Waived first year, $95 thereafter

The basics of this card is that you get 2 free nights plus breakfast for 2 (worth $100) after $1000 spend in 3 months. This card may not be worth keeping after the first year, but the value of the 2 nights can be pretty significant.

Get your spouse to apply and that’s four nights. If you are the skiing type, you might consider using these 4 nights at the Fairmont Banff in Canada ($559 Canadian dollars a night)

There you have it! If you are a couple going on a honeymoon, these credit cards could make it luxurious, yet affordable or very budget friendly.

These are the best hotel credit cards out there and each of them gives you at least 2 nights. There’s hundreds of properties out there where you can extract great value from redeeming these nights.

Don’t waste the free nights on some crappy hotels. You can’t get these cards again and again, so plan well, and make the free nights count!