Tax season is around the corner. If you pay quarterly estimated taxes, it’s always tax season. Paying taxes with a credit card is easy and convenient, but does it make sense to do so? Let’s take a look.

Paying Taxes With A Credit Card:

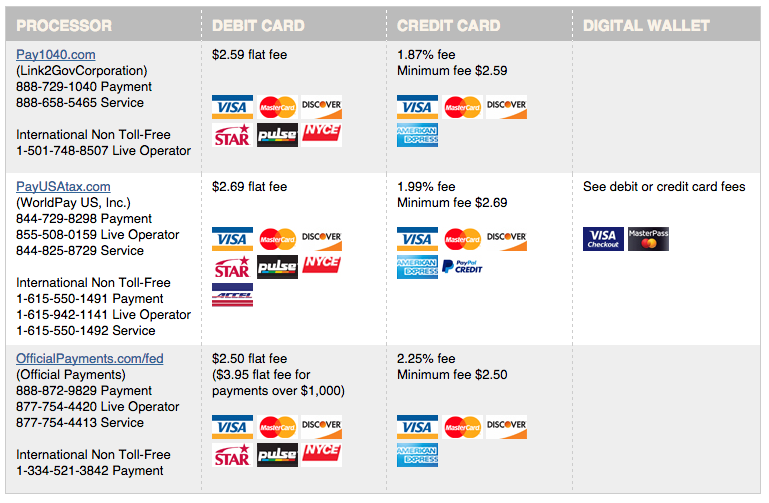

The IRS allows an individual or business to pay taxes with a credit card. However, you have to go through a 3rd party processor. That 3rd party processor charges fees for the transaction. Visa, Mastercard, Discover, and American Express are all accepted. According the IRS site, there are now 3 processors which charge the following fees:

- Pay1040.com: 1.87% fee

- PayUSAtax.com: 1.99% fee

- OfficialPayments.com/fed: 2.25% fee

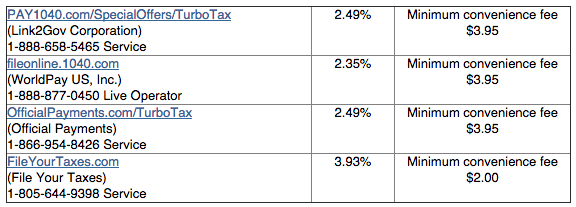

Keep in mind that these are the fees when you pay taxes directly online or on the phone with one of these processors. The fees are different if you use a credit card to pay through an e-file software (i.e turbotax).

What are the fees if I use a credit card to pay taxes when e-filed through a software?

The fees are much higher when you pay through an e-file software, but are included below for completion. It probably doesn’t make sense to pay such high fees.

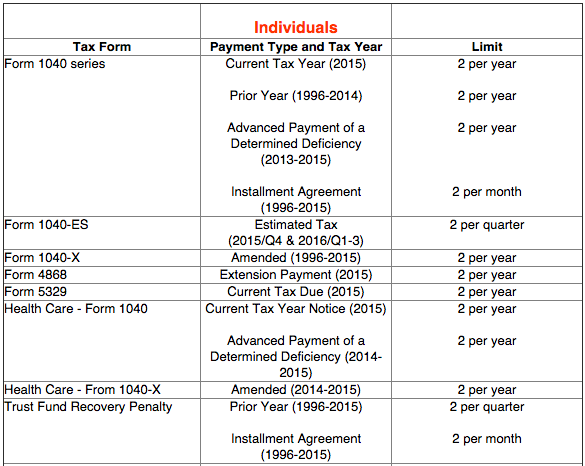

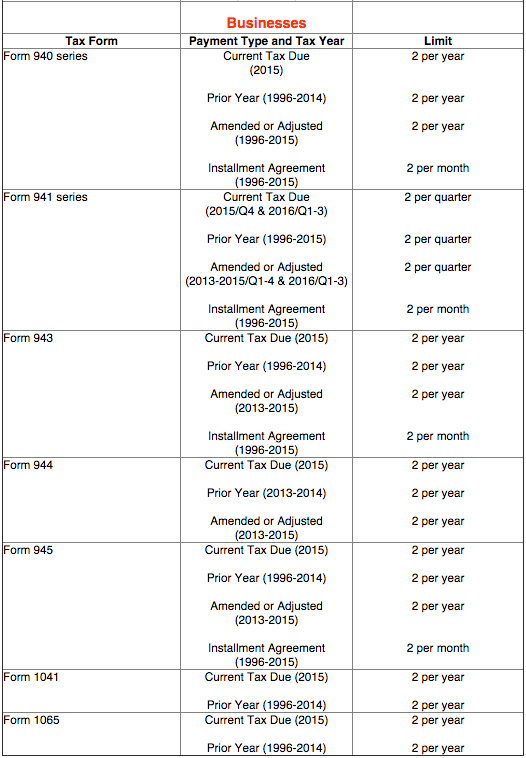

What taxes can you pay and how many payments can you make?

The table below from the IRS site lists what taxes you can pay and the limits on the number of payments you can make. For people that pay estimated quarterly taxes (1040-ES), notice that the limit is 2 per quarter. However, that’s 2 per quarter per processor. With the three processors listed above, you could make a total of 6 payments. There are reports that you can even make more number of payments if you pay on the phone.

Your processing fees are tax deductible

You are paying a minimum fee of 1.87% fee when you pay taxes. Keep in mind that these fees are tax deductible. According to the IRS website and this article on Investopedia:

The Internal Revenue Service, or IRS, offers electronic payment systems for tax purposes, but other federal laws prohibit the IRS from directly paying any of the fees associated with debit or credit transactions. The IRS created a deduction in 2009 to offset the fee assessed by your credit card company when you make electronic tax payments. This deduction is included in your miscellaneous itemized deductions, which by law cannot exceed 2% of your adjusted gross income.

How can you check if payment has been received?

If you want to check that the IRS has received your payment, create an account on the Electronic Federal Tax Payment System (EFTPS)

If you pay through one of the processors above, your payment will post in a few days. However, the IRS will recognize the date it was paid, not the date the payment posted. Just pay before the deadline and you should be good.

Is it worth it?

The basic premise is that since the minimum processing fee is 1.87%, it would make sense to use a credit card only if the benefits exceed the fee. For example, the Fidelity Visa gives you 2% cash back on every purchase. So, paying your taxes on that would net you 0.13%. On a $5000 tax bill, you would make $65.

If you prefer to collect miles or points, another way to look at it is that you are paying 1.87 cents per mile or point. If you can redeem your miles or points for more than 1.87 cents each, then it could be worth using a credit card. For example, SPG points can certainly be redeemed for over 2.2 cents in value. Thus buying them for 1.87 cents each with the Starwood American Express might be worth it to you.

There are a few credit cards and other situations where paying taxes with a credit card would make sense. That deserves a post on its own, so look for that in the near future.

The same idea applies to paying property taxes as well. If you pay property taxes, check with your county to see what processing fee they charge you for using a credit card. If the rewards outweigh the fee to you, then go for it.

Of course, paying with a credit card is never a good idea if you can’t pay your bill in full when the statement closes.

Pingback: The Best Credit Cards For Paying Taxes